4 Reasons to Hedge

First

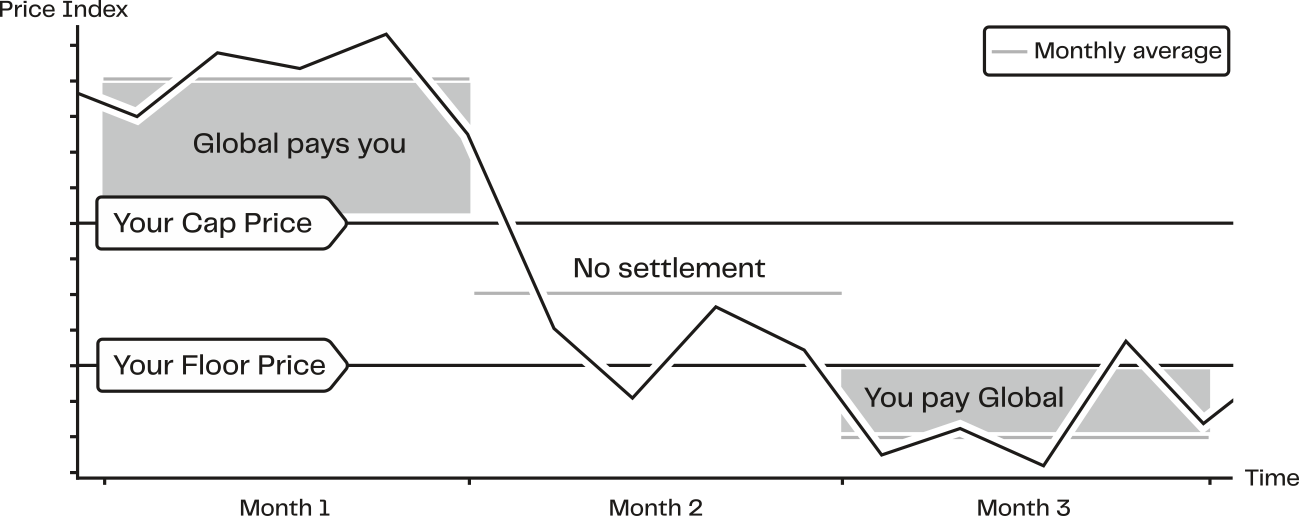

Hedging against energy price risk means strategically using financial instruments or market strategies to offset the risk of any adverse price movements. Thus hedging, for the most part, is a technique that is meant to reduce potential loss (and not maximize potential gains)

Second

Companies attempt to hedge price changes because those fluctuations are risks peripheral to the central business in which they operate

Third

Hedging can also be used to improve or maintain competitiveness. Companies don’t exist in isolation; they compete with other domestic companies in their sector as well as globally

Fourth

Firms that have good risk management programs can use this stability to reduce their cost of funding or to lower their prices in markets that are deemed to be strategic and essential to the future progress of their companies

At GRM we plan to be the global energy risk manager of choice, providing access to all energy markets and promoting cleaner energy use through developing risk management solutions to help support those nascent and life-saving markets.

In practice

Through our deep derivatives expertise and full participation in global energy markets, GRM provides consumers and producers of energy commodities the ability to access the right energy commodity markets to manage all energy price risks inherent within their operations efficiently.

Get Informed

Effective risk management starts with questions. Get in touch and we will answer yours.