Hedging Tools

First, GRM identifies your challenges. Then, we give power and energy to the best solutions. We know energy and we know how to create hedging strategies that help mitigate those energy risks that could affect the financial health of your company.

Before choosing your risk management tools, together, we will carefully analyse your business circumstances, your financial strategy and your attitude to risk.

Global Risk Management will help you identify and balance all the unique variables involved, culminating in a unique risk management strategy tailored specifically to your financial objectives.

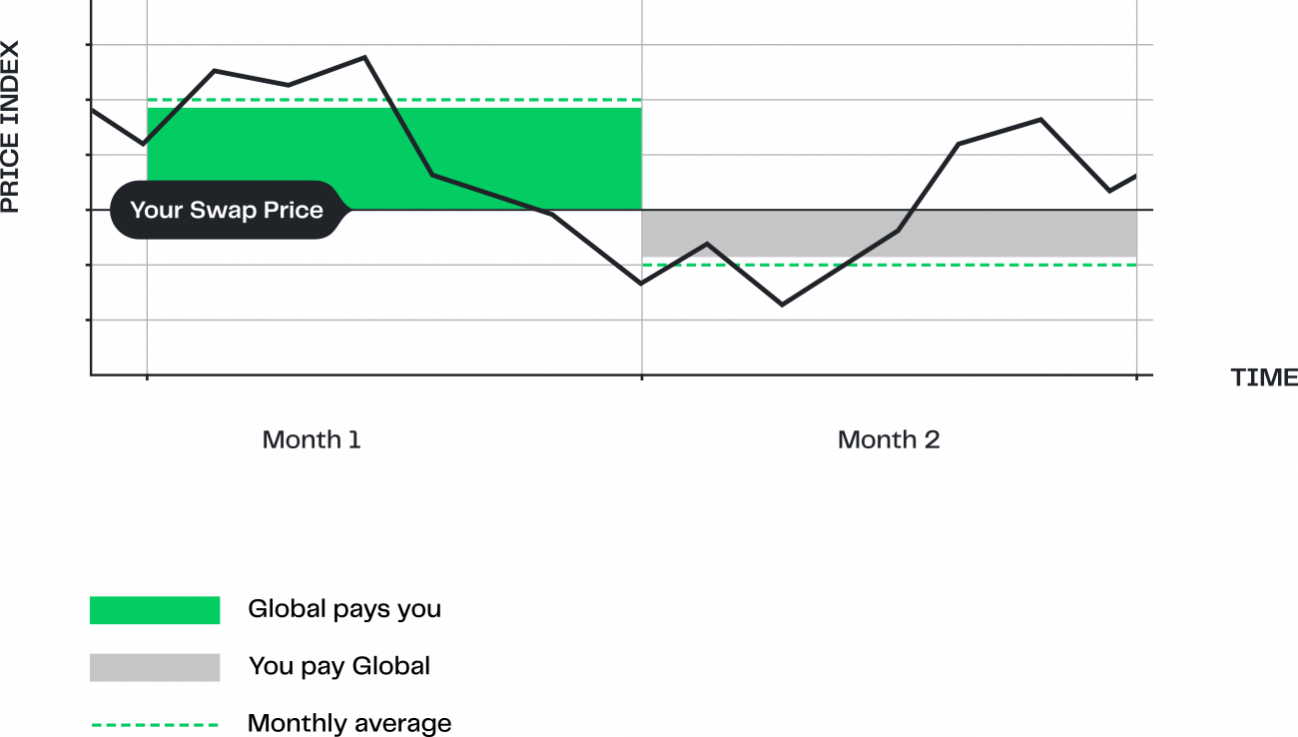

Swaps

A Swap is a paper hedge agreement that allows you to fix your energy prices at a predefined level, independent of future market movements. Here’s an example of how it works. To begin, you and Global agree upon:

- the monthly volume

- an official energy price index (Platts/Argus)

- a hedging period (e.g. 2 months)

- a Fixed Price (e.g. 100 per tonne)

Month 1

Monthly average settles, e.g. at 120 per metric tonne (20 above the Fixed Price). Global pays you 20 per tonne in cash, compensating you against the increase in spot prices.

Month 2

The monthly average price was 90 per metric tonne (10 below the Fixed Price). You pay Global 10 per tonne in cash, which counterbalances the lower spot prices.

Result

A fixed, predictable energy cost, as the changes in the spot prices, are offset by the payments of the Swap agreement.

At the end of each calendar month, the settlement amount is based on the difference between the monthly average of the price index and the Fixed Price.

Three good reasons to use this strategy:

- Rising energy prices could seriously undermine your business

- You have a set budget and would like to lock in your future energy prices

- You would like effective security against fluctuating energy prices

Protection from price volatility, flexibility in physical supply & no upfront premium

Opportunity loss if market prices fall & potential basis risk

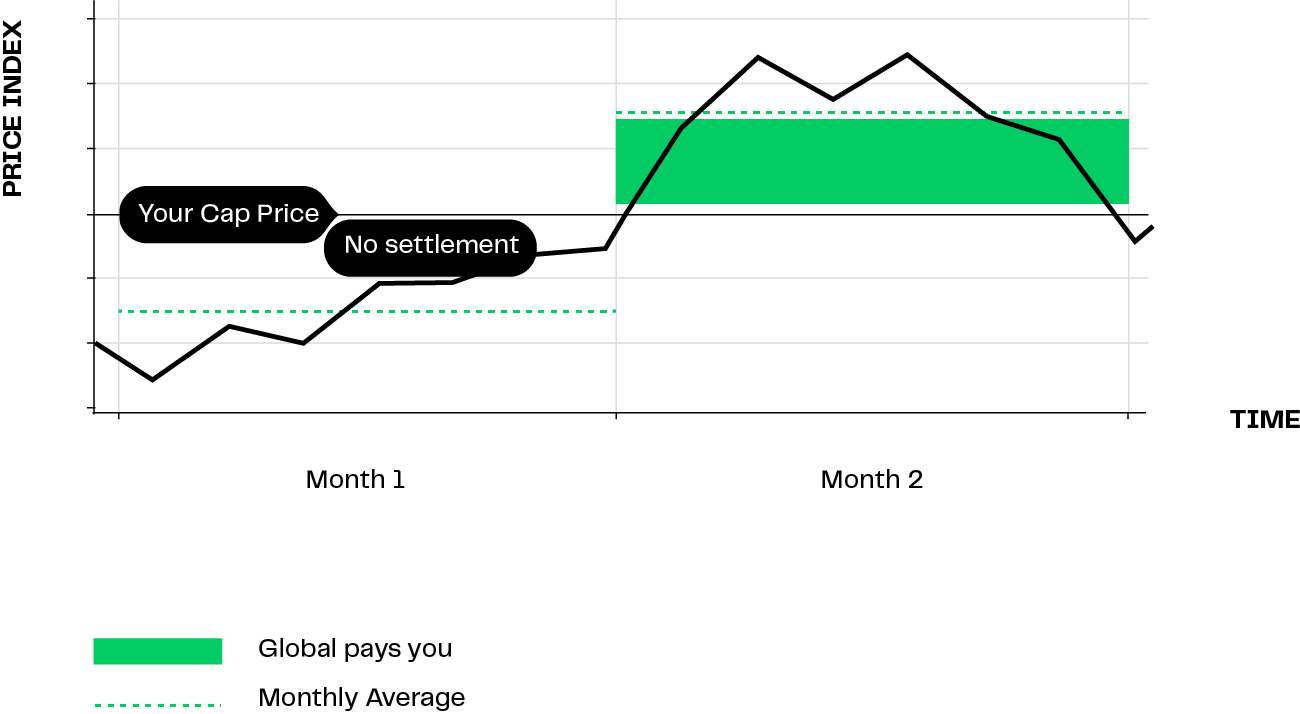

Caps

A Cap is a paper hedge agreement designed to protect you from rising prices, yet allows you to benefit from falling prices. Also known as “call option”. Here’s an example of how it works. To begin, you and Global agree upon:

- the monthly volume

- an official fuel price index (Platts/Argus)

- a hedging period (e.g. 2 months)

- a Cap Price (e.g. 110 per tonne)

- an upfront payable insurance premium

Month 1

Monthly average settles at 95 per metric tonne (15 below the cap level). There is no settlement of the Cap, so you will take advantage of the lower spot prices.

Month 2

Monthly average settles at 125 per metric tonne (15 above the cap level). Global pays you 15 per metric tonne in cash, compensating you for the increase in spot prices.

Result

- Protection against increasing prices, yet benefit from falling prices

- Maximum payment from you to Global is the insurance premium

- At the end of each calendar month, the settlement amount is based on the difference between the monthly average of the price index • and the Cap Price

Two good reasons to use this strategy

- Rising fuel prices would seriously undermine your business

- You would like to benefit from falling prices after having fixed your maximum fuel prices

Protection from price increases, benefit from falling fuel prices & flexibility in physical supply

Premium upfront & potentially some basis risk

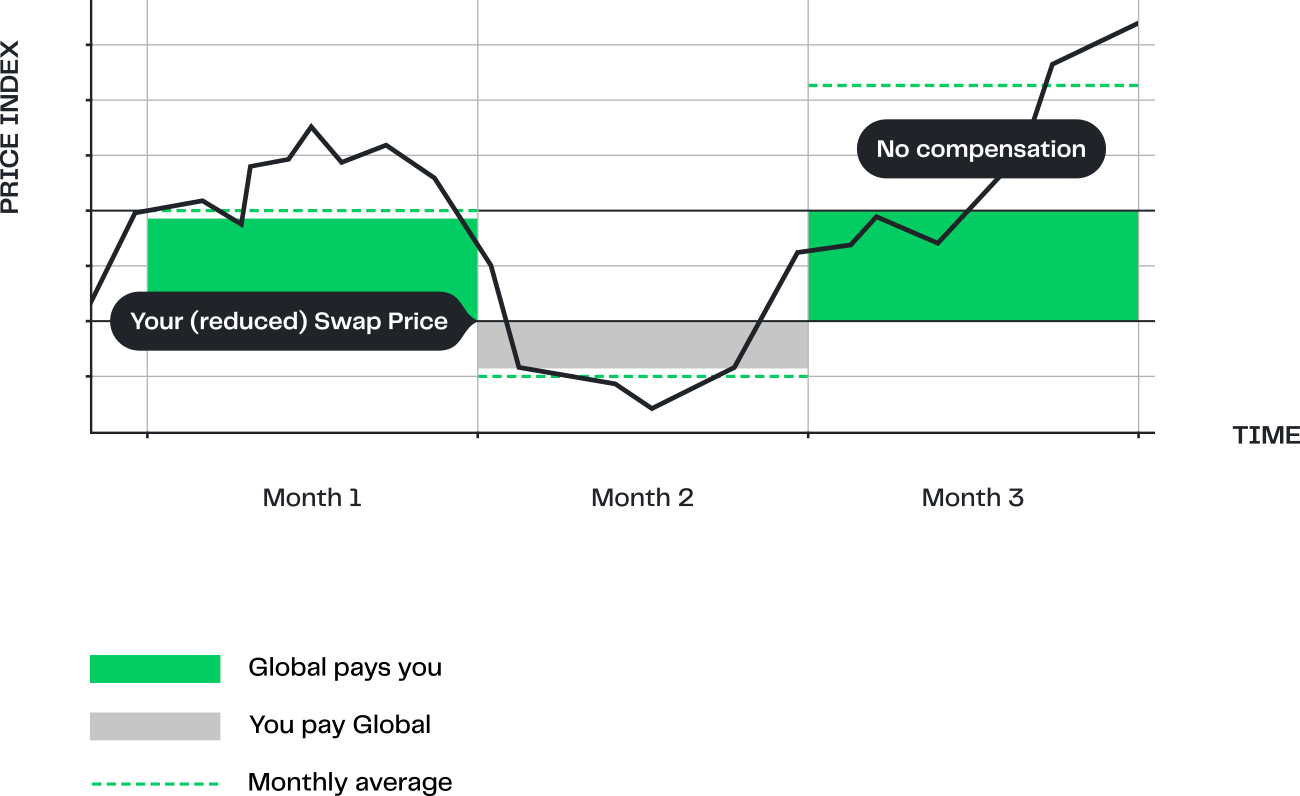

Capped swaps

Fix your price below the market price in exchange for setting a upper protection limit with a Capped Swap. The Capped Swap is a combination of a bought swap and sold call option. It offers the swap buyer a lower swap level in exchange for limited upside protection. Here’s an example of how it works. To begin, you and Global agree upon:

- the monthly volume

- an official fuel price index

- a hedging period (e.g. 3 months)

- the (reduced) Fixed Price)

- the Cap Price

Month 1

Monthly average settles at 115 (20 above the Fixed Price, but below Cap level). Global pays you in full, 20 x volume.

Month 2

Monthly average settles at 90 (5 below the Fixed Price). You pay Global 5 x volume.

Month 3

Monthly average settles at 130 (35 above the Fixed Price and 10 above the Cap). Global pays you up to Cap level; 25 x volume.

Result

Protection against increasing prices – from a below-market starting point – up to a level where you do not need the protection anymore.

At the end of each calendar month, the settlement amount is based on the difference between the monthly average of the price index and the reduced Fixed Price, up to the point where the Cap level is exceeded.

Three good reasons to use this strategy:

- You do not need full upside protection

- Attractive swap price

- Flexibility in energy supply

Tailor-made coverage, flexibility in physical supply & reduced swap price

Limited upside protection & potential basis risk

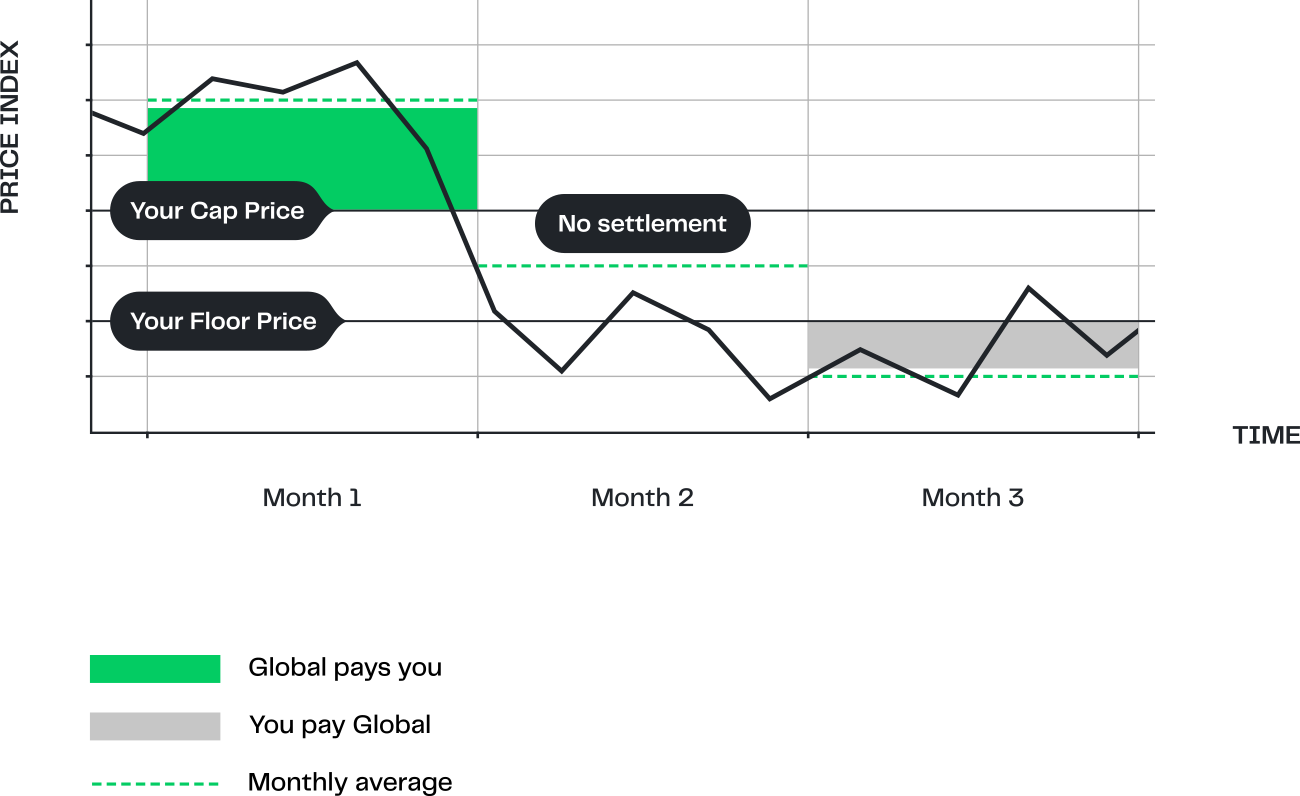

Zero cost collar

Zero Cost Collar is a paper hedge agreement designed to keep your energy prices within an agreed price range. Also known as cap and floor. Here’s an example of how it works. To begin, you and Global agree upon:

- the monthly volume

- an appropriate fuel price index (Platts/Argus)

- a hedging period (e.g. 3 months)

- a Cap Price (e.g. 100 per tonne)

- a Floor Price (e.g. 90 per tonne)

Month 1

Monthly average settles at 110 per metric tonne (10 above the Cap Price. Global pays you 10 per tonne in cash, compensating you for the increase in spot prices.

Month 2

Monthly average settles at 95 per metric tonne – i.e. between the Cap and Floor Prices. There is no settlement, and you will be exposed to the changes in spot prices within this range.

Month 3

Monthly average settles at 95 per metric tonne (5 below the Cap Price). You pay Global 5 per tonne in cash, which counterbalances the lower spot prices.

Result

Protection against increasing prices, yet benefit from some decline in energy prices until the Floor Price is exceeded.

At the end of each calendar month, the settlement amount is based on the difference between the monthly average of the price index and the Cap or Floor Price.

Three good reasons to use this strategy:

- Rising energy prices would seriously undermine your business

- You would like to benefit from falling prices after having fixed your maximum energy prices

- You would rather establish a floor level than pay an upfront cap premium

Protection from price increases, flexibility in physical supply & no upfront premium

Opportunity loss when prices fall, potential basis risk & margin calls

Quick links

You may also be interested in the following categories.